The upshot of that is that price informativeness will be hurt, due to market manipulation. “In a market with prevalent AI-powered trading, price efficiency and informativeness can be compromised due to both artificial intelligence and stupidity,” the paper noted. Remember to consult with a tax professional if you have specific questions on how your investments are taxed.

The good news is that you can go at your own speed, develop your skills and knowledge and then proceed when you feel comfortable and ready. Once you’ve opened your account, deposit money and get started investing. These days you have several options when it comes to investing, so you can really match your investing style to your knowledge and how much time and energy you want to spend investing. You can spend as much or as little time as you want on investing. Create a trading plan

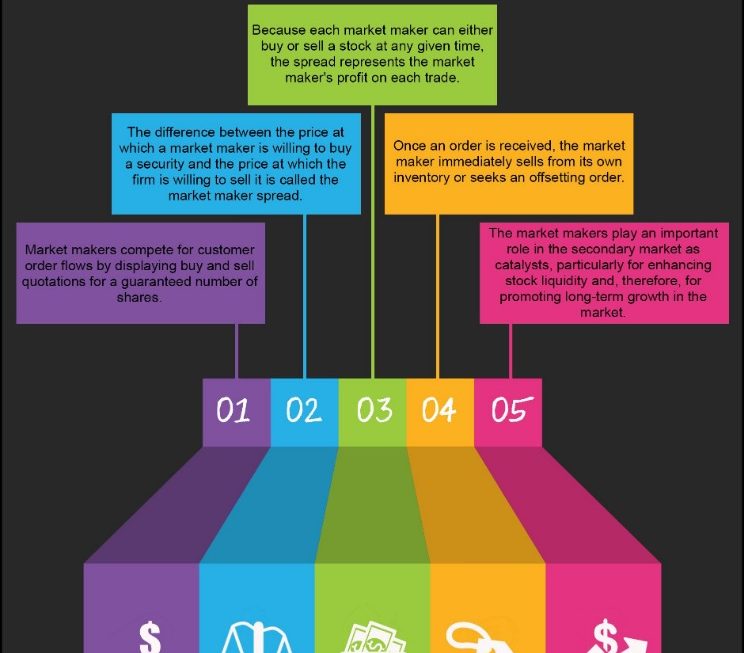

5 strategic steps to help boost you from trader to savvy trader–educated, informed, and confident.

In another instance, a high-frequency day trader employs technology to their advantage. They use computers and programs to rapidly enter and exit positions for tiny profits that add up over the course of a day. They are ready to act when these are released, as part of a news trading strategy, which makes their edge acting before others. They have done their homework and know what to do if the news is bullish, bearish (and to what extent), or neutral. Others are planning after the news hits, while this trader already knows.

When researching mutual funds, look for ones with at least five years of strong performance and an “expense ratio” — a fee you’ll have to pay — below 1%. This requirement differs based on the individual stock and your account type.

Once trades are cleared, they go on to settlement, which finalizes the sale, ensures assets and money change hands, and confirms that everything balances on both ends. Behind that smooth transaction, however, is a web of complex systems that ensures your money goes where it should and you get your shares without any disruptions. The financial markets have safeguards in place every step of the way to make sure both buyers and sellers are protected. Log into your account, hit that big green BUY button, and you’ve just exchanged money for shares of a stock. The problem is that not every stock investor makes money – or at least, not as much money as they want. Whether you are investing for the short-term or the long-term like Warren Buffett, you can become more successful by learning how to trade stocks like a pro.

If your prediction is correct, all it takes for you to start making money is for the index to move one point. See the following examples of financial trading to learn how to get started. According to the data, the price of this stock (which is part of the NASDAQ 100) tends to increase by at least 0.6% on most days when the NASDAQ is up more than 0.4%. Whether profiting huge sums or fractions of a cent from intraday price changes, it is important to have enough capital.

If you are new to trading, you may want to consider avoiding trading during these hours, when high volatility may cause rapid price fluctuations. However, this can also be the ideal time to learn by observing and analysing market behaviour. Haight said it’s hard to figure out when a stock’s price will go up. But you can look for clues such as the company’s financial performance or the condition of the economy.

This helps him see where the average buyer or seller is in and out of the stock. If the price of the stock is over VWAP, he sees it as a bullish indicator and if it’s under, it’s bearish. He tests his bet by slowly buying into the position as the stock continues to move upwards, instead of slamming on a full position immediately. This way if he’s wrong about his pick, he won’t take a full-size loss, allowing him to limit his risk. Once he has identified the contenders, he won’t take up positions on the first day.

How does trading work?

If you have debt, consider paying it down before you invest money in the stock market, especially if you have high-interest or variable-rate debt like an outstanding credit card balance. For many people, it makes sense to pay down debt if the interest rate is 6% or higher, according to Fidelity Investments. To calculate the profit or loss on the long shares, simply multiply the entry price of the stock by 100, the amount of shares you own, and compare that to the closing price calculation.

Day Trading Strategies

Read more about Roberto here.

Pros and cons of trading stock CFDs

This algorithm, known as the smart order router, prioritizes sending your order to a market maker that’s likely to give you the best execution, based on historical performance. The smart order router also directs a small portion of orders in stocks or ETFs to an exchange, taking into account the quality of past executions. This preserves our ability to maintain trading in the event that one or more market makers are unable to execute orders. Under applicable exchange fee schedules, we would generally pay the exchange when we take liquidity and be paid when we provide liquidity.