Market making services have become a crucial component in today’s financial markets. They play a significant role in ensuring liquidity and maintaining orderly trading by constantly providing buy and sell prices for a wide range of assets. Let’s delve deeper into the world of market making and its impact on trading.

The Role of Market Making Services

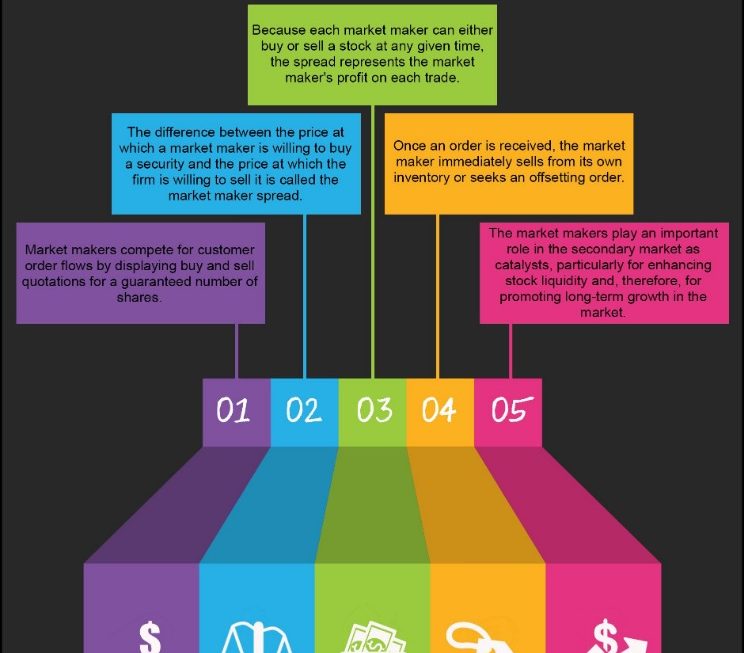

Market making services act as intermediaries between buyers and sellers in financial markets. They are responsible for providing continuous buy and sell quotes for a specific set of securities or assets. By doing so, market makers help ensure that there is always a ready market for these assets, enabling investors to buy or sell at any time.

Key Functions of Market Makers

- Providing liquidity: Market makers enhance market liquidity by offering continuous buy and sell quotes, reducing price volatility.

- Price stabilization: Market makers help stabilize prices by absorbing excess supply or demand, thereby preventing sharp price movements.

- Risk management: Market makers manage their inventory of assets, balancing the need to provide liquidity with the risks of holding positions.

Benefits of Market Making Services

Market making services offer several benefits to traders and investors:

- Improved liquidity: Market makers ensure that there is always a market for assets, making it easier for investors to buy or sell.

- Tight bid-ask spreads: By providing competitive buy and sell prices, market makers help reduce transaction costs for investors.

- Price stability: Market makers help prevent sharp price movements by absorbing excess supply or demand.

Frequently Asked Questions

What assets do market makers trade?

Market makers typically focus on liquid assets such as stocks, bonds, currencies, and commodities. They may also provide market making services for cryptocurrencies and other digital assets.

Read more about market making services here.

How do market makers make money?

Market makers make money by earning the spread between the buy and sell prices they quote. They may also charge commissions or fees for their services.

Overall, market making services play a crucial role in ensuring the smooth functioning of financial markets. By providing liquidity, price stability, and competitive pricing, market makers contribute to a more efficient and orderly trading environment.